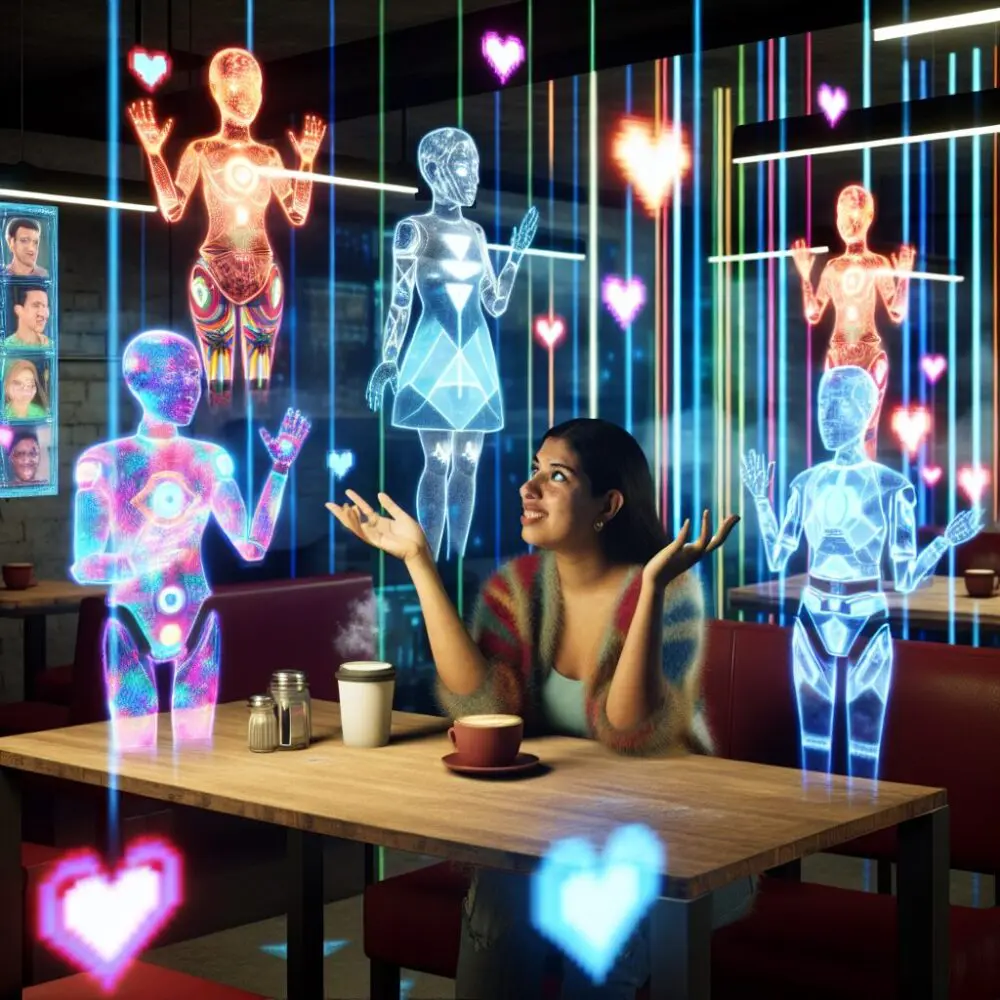

Exploring the Surreal Experience of Dating Multiple AI Partners Simultaneously

“`html Exploring the Surreal Experience of Dating Multiple AI Partners Simultaneously Exploring the Surreal Experience of Dating Multiple AI Partners

“`html

Amid an ever-evolving landscape where technology stocks have become a focal point for investors, Nancy Pelosi’s decision to engage in artificial intelligence (AI) investments reveals broader strategies that could significantly impact the market. Her bold move into what some might consider an “unprofitable” segment speaks volumes about the confidence in this burgeoning field. In this article, we will delve into the mechanics of AI investments, the strategic reasoning behind Pelosi’s choice, and the future potential that this sector holds.

AI is no longer a futuristic concept; it’s a reality transforming industries. From healthcare to finance and automotive to retail, artificial intelligence is the driving force behind innovation. The market itself is witnessing a meteoric rise, with projections indicating exponential growth in the coming years. Here’s why AI continues to capture investor attention:

Nancy Pelosi’s venture into AI investments, particularly into stocks that are considered “unprofitable,” highlights a calculated risk that may offer substantial returns. So, what makes this decision noteworthy?

Investing in AI is not without its challenges. Understanding the risks involved is crucial for any investor:

Investors like Nancy Pelosi often rely on a combination of thorough market analysis, consultation with experts, and leveraging insights from technological trends to address these challenges. Here’s a strategic approach to mitigating risks:

AI technology is destined to become an intrinsic component of modern society, and its financial market implications are profound. As AI innovation accelerates, we can anticipate several key developments:

Nancy Pelosi’s investment in AI, particularly in perceived “unprofitable” stocks, underscores a critical evaluation of the vast potential AI holds. Her strategic foresight offers a blueprint for interested investors aiming to capitalize on the technological frontier. The lesson resonates clear: while AI investments carry inherent risks, the payoff for well-timed and calculated risks can surpass expectations. As the world embraces AI, those on the forefront of this revolution stand to gain significantly. It’s not just an investment in technology but a stake in the future.

In conclusion, standing at the intersection of technology and investment gives an advantageous view over potential growth and innovation. For investors prepared to weather the volatility and navigate the AI journey, the reward promises to redefine excellence in the modern marketplace.

“`

“`html Exploring the Surreal Experience of Dating Multiple AI Partners Simultaneously Exploring the Surreal Experience of Dating Multiple AI Partners

“`html Exploring the Strange Dynamics of Dating Multiple AI Partners In an era where artificial intelligence continues to evolve at